Learn about factors that affect CIBIL score and steps for its improvement

New Delhi : Two years ago, the government had announced the attractive ‘loan in 59 minutes scheme’. However, as of last year, most banks offering these loans had rejected around 52% of loan applications. That means it is probably a good time to turn to NBFCs for loans and some of the most attractive loan products are offered on Finserv MARKETS.

Instant Loans on Finserv MARKETS

If you have big dreams but insufficient funds to fulfill them, an instant loan can take care of it right away. There is a range of loans such as personal loans, professional loans, two-wheeler loans, and more, available on Finserv MARKETS. All of these loans come with an easy online process with approvals within just 3 minutes and disbursals within 24 hours. The process involves minimal documentation without any need to visit offices!

The reasons for rejection of loan applications are many. One of the most common reasons is a low CIBIL score. Before knowing how to check CIBIL score, let us first see what a CIBIL score means.

What is CIBIL score?

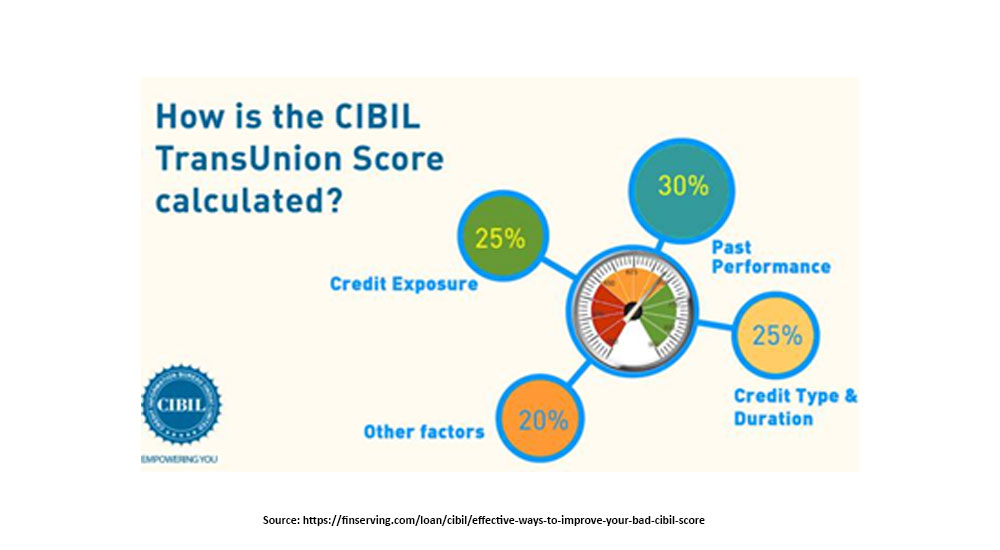

Your CIBIL score is an indicator of your creditworthiness. It is calculated on the basis of your credit history mentioned in your CIBIL Report, aka your Credit Information Report or CIR. Your CIR is a record of your credit repayment to different lenders for different types of loans that you have taken over a period of time. It does not reflect your savings or investments.

Your credit score ranges from 300 to 900. Generally, any score above 700 is considered to be good.

How to check CIBIL score?

- Fill a form on the official CIBIL website.

- Enter the required personal details i.e. name, address, contact number, etc.

- Pay the required fees for your Credit Information Report.

- Your CIBIL score report will then be sent to you via email.

- Alternatively, you can also follow an offline process. You can send the required documents along with a demand draft for the fees to CIBIL’s office in Mumbai.

Now that you know how to check CIBIL score, let us have a look at the various factors that affect your CIBIL score.

Timely repayment

If you check CIBIL score it will mention due dates of your pending loan EMIs. Therefore, paying loans back on time is necessary for maintaining a good CIBIL score.

Multiple applications

If you apply to multiple lenders, it makes a bad case for you. So it’s advisable not to cluster your applications by passing it to multiple lenders instead think of the lender who suits best to your requirements and then apply.

Negative markings

You could attract negative remarks for a lot of reasons including payment defaults, written off loans, settled loans, and more. High negative marks will not improve CIBIL score and reduce the chances of securing a new loan.

Hard inquiries

A hard inquiry is when a lender you have applied to requests for access to your CIR before approving a new loan. Any lender could check CIBIL score and report before approval and hence it is best to apply to only one lender who you are confident about.

Credit card limit

Every time you increase your credit card limit, it reflects upon your CIBIL score. It indicates that you are highly dependent upon your credit card and do not improve CIBIL score.

Closing of previous loans

If you default upon your current loans, your new loan applications will be affected. It is best to close all existing loans and secure a good score before applying for a new one.

Error-free CIR

Ideally, you should check your CIR once every three months. This is not just for keeping track of loan payments and defaults but also errors in your personal information. If you find any errors, correct them by logging onto the credit bureau website.

Conclusion

Now that you know how to improve CIBIL score and maintain it, you are almost set to apply for a new loan. If you want to save time and effort, you could go for an instant online loan, like a Bajaj Finserv Instant Loan.

Bajaj Finserv Loans

Instant Loans available on Finserv MARKETS come without tedious paperwork and can be processed within a day’s time. Finserv MARKETS is a unique online portal which offers more than 500 financial and lifestyle products to choose from. With the backing of more than 100 million customers, Finserv MARKETS is your trustworthy and go-to platform to find personal loans, professional loans, business loans, vehicle loans, home loans, loans against property.